Building Credit Blog

Building Credit

Building credit is a crucial step toward achieving financial goals like buying a home, starting a business, or securing better interest rates. One lesser-known yet effective way to boost your credit score is by using jewelry financing to establish and manage revolving credit.

1. Understanding Revolving Credit

Revolving credit, such as credit cards or store financing accounts, allows you to borrow up to a set limit, repay, and borrow again. It’s different from installment loans (like car loans) because you have flexibility in how much you repay each month. Jewelry stores often offer revolving credit options, allowing you to purchase items like engagement rings, necklaces, or watches while building credit.

2. Why Jewelry Financing?

Many jewelry retailers offer promotional financing plans for large purchases. These may include:

- Zero-interest plans: If paid within a set period, you avoid interest charges.

- Accessible credit lines: Retailers often approve higher credit limits than traditional credit cards.

- Credit-building opportunities: Timely payments can improve your credit score, provided the retailer reports to major credit bureaus.

3. Steps to Build Credit

- Open the Account Wisely

- Shop with reputable jewelry retailers that report to credit bureaus.

- Apply only if you’re confident about your approval odds to avoid unnecessary hard inquiries.

- Use the Credit Strategically

- Aim to utilize no more than 30% of your limit.

- Keeping your utilization low shows creditors that you manage debt responsibly.

- Make Payments on Time

- Late payments can significantly harm your credit score. Set reminders or automate payments to ensure punctuality.

- Pay More Than the Minimum

- Reducing the balance quickly lowers your credit utilization ratio, positively affecting your credit score.

- Monitor Your Credit Report

- Regularly review your credit report for inaccuracies or missed reporting. Use tools like Credit Karma or annualcreditreport.com.

4. Benefits of Managing a Jewelry Revolving Credit Line

- Higher Credit Score: Consistent payments and low utilization improve your creditworthiness.

- Better Credit Mix: Adding revolving credit to your profile diversifies your credit types, which is beneficial for your credit score.

- Opportunity for Rewards: Some stores may offer perks like discounts or rewards points for using their credit lines.

5. Pitfalls to Avoid

- Overspending: Avoid purchasing beyond your means just to utilize the credit.

- Interest Accumulation: If not paid off within the promotional period, deferred interest could cost you more than you save.

- Ignoring Terms: Carefully read the fine print to understand fees, penalties, and interest rates.

6. Long-Term Strategy

Using jewelry revolving credit isn’t just about the short term. Once you’ve built a strong credit history, you can transition to other financial tools like high-limit credit cards or mortgages. This jewelry account will serve as one of the steppingstones to achieving financial freedom.

Final Thoughts

Whether you’re buying a timeless piece for yourself or celebrating a special occasion, the key is to balance the enjoyment of your purchase with the responsibility of sound financial management.

By maintaining low credit utilization, making timely payments, and staying informed, you’ll not only enjoy your jewelry but also lay the foundation for a brighter financial future.

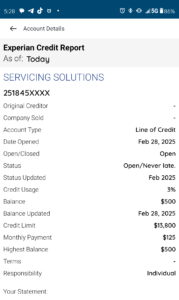

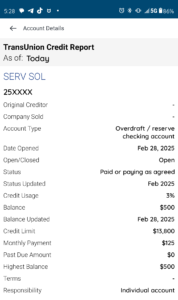

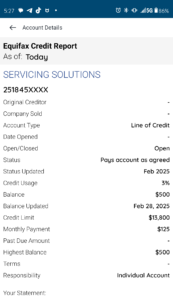

Line Is Showing on all 3 Bureau’s✅ with up to 15k revolving below is an example of one of our satisfied customers

Greetings!

I just wanted to show you what is showing through my Experian app as promised! See attachment. I will also pull the credit report PDFs to review the differences also.

Thank you again! I know you all called prior also! Thank you all for your diligence and patience!

Mostly Appreciated!

-Kimberly

What are your thoughts? Share your experience in the comments!